Welcome to Wright Doig & Co

Based in Croydon Victoria, we provide accounting and financial planning services to individuals, families, sole traders, small businesses and companies/trusts.

Welcome

An integral part of our service at Wright Doig & Co. is our ability to respond quickly and personally to your needs.

We are big enough to serve your needs and small enough to care about the success of you and your business.

We aim for you to be completely satisfied and therefore you can expect from us:

- Courteous friendly and personal service from our entire team;

- Uncompromising integrity, you can be assured of our total honesty and regard for the confidentiality of your financial affairs;

- Practical advice of the highest standard;

- Attention to your individual needs; and

- Reasonable rates for the services you require.

We're here to help you. That's our focus.

Our Services

-

Taxation

- Income Tax Returns

- Fringe Benefits Tax

- Taxation Audits

- Specialist Advice

- Business Activity Statements

- Tax Planning

-

Accounting

- Statutory Requirements

- Management Accounting

- Company & Secretarial

- Reporting

- Computer Accounting Software

- Payroll Bureau Service

-

Business Development

- Business Plans

- Marketing Advice

- Budgets & Projections

- Management Advice

- Strategic Planning

- Analysis & Monitoring

-

Business Appraisal

- Business Finance

- New Business Appraisals

- Leasing

- Negative Gearing

- Advice on Buying & Selling Businesses

-

Financial Planning

- Investment Advice

- Redundancy/Retirement Planning

- Superannuation

- Portfolio Management

- Buying and Selling Shares

- Personal Risk Insurance

We really listen. We never assume. We really understand.

About Us

We are a CPA firm that doesn’t just “crunch the numbers” – we offer our clients pro-active service and creative solutions in line with the knowledge and advice you need to succeed.

We work with an extensive team of allied professionals to make sure all your financial needs are met.

With a focus on technology use to improve efficiency we have less staff numbers than many firms without sacrificing the quality of service and level of advice provided.

We are proud that our clients include family groups who have been clients of the firm since its inception in 1988. These clients together with the ongoing referral of new clients prove that we are doing the right thing by our clients. Our clients are involved in a variety of industries, occupations and locations throughout Australia and Internationally.

David Wright

Partner

Benita Wright

Partner

David and Benita live locally and have 3 grown children who they are extremely proud of. They have both been actively involved in volunteering in local sporting clubs which their children have played at. They are excited to no longer be a ‘Taxi Driver’ for their children’s sporting commitments but will still be there to cheer them on regularly just not all the time. They are both looking forward to having time to get to AFL games and to get away camping.

Having worked together for over 25 years without `killing’ each other they are very much aware of what it takes for a business to succeed and the need for Work/Life Balance.

We're here to make a difference.

Latest News

All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

Federal Budget 2025-26 – Papers and Fact...

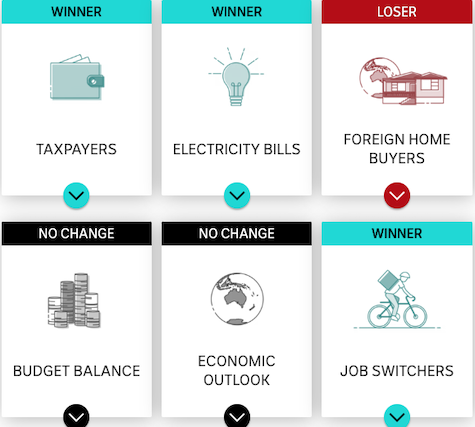

Winners and Losers - Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal election...

Building Australia's future and Budget Priorities

Building Australia's future and Budget...

ATO outlines focus areas for SMSF auditor compliance in 2025

The ATO has issued guidance on what it will focus on regarding auditor compliance for...

ATO to push non-compliant businesses to monthly GST reporting

Small businesses with a history of not complying with their obligations may be moved to monthly GST reporting...

ASIC pledges to continue online scam blitz

The corporate regulator has revealed online scammers will remain “squarely in the crosshairs”, with 13...

Tax Office puts contractors on notice over misreporting of income

The ATO's data matching programs have identified contractors that are incorrectly reporting or omitting...

What does the proposed changes to HELP loans mean?

If you are one of the millions of Australians with Higher Education Loan Program (HELP) debt, the proposed...

Develop your financial future.

Tools & Resources

Talk to us. We're great listeners.

Contact Us

Contact Details

- (03) 9725 2789

- admin@wrightdoig.com.au

- 294 Mt Dandenong Road, Croydon VIC 3136

- PO Box 1089, Croydon VIC 3136